Debt Snowball Worksheet & Trackers | Free PDF Printables

Last Updated on December 8, 2025

Use these free printable debt snowball worksheets and trackers to simplify your monthly payments and speed up your debt payoff. Whether you are paying off car loans, credit card debt, mortgages, student loans, or personal loans, our worksheets guide you through each step, from the smallest to the largest debt, using the snowball method. This technique builds momentum and helps you stay focused by showing real progress as debts are paid off one by one. With our debt repayment planners, you can easily stay on track, see the snowball effect in action, and work toward becoming completely debt-free. For more debt planners, visit our Debt Payoff planners and trackers collection page.

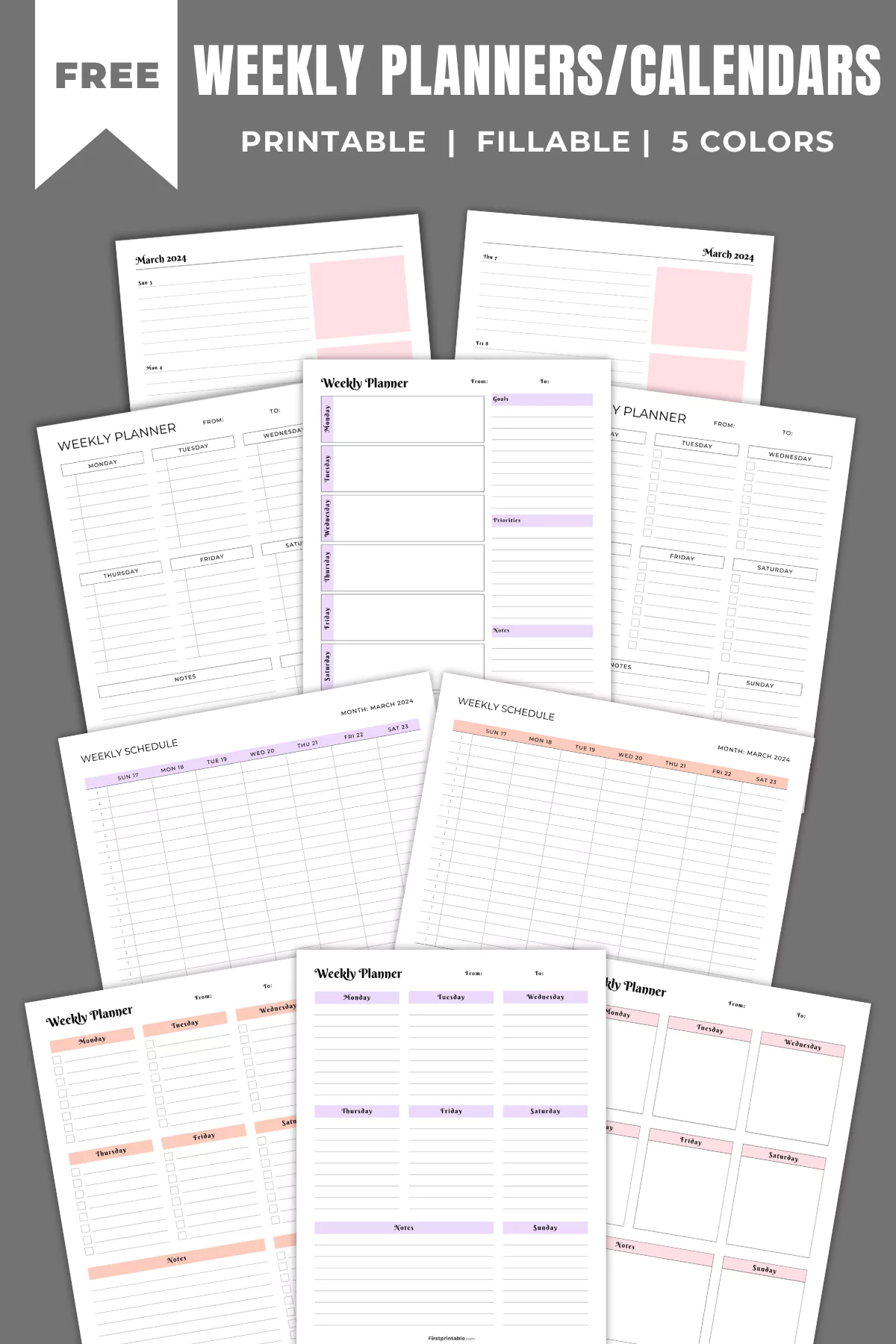

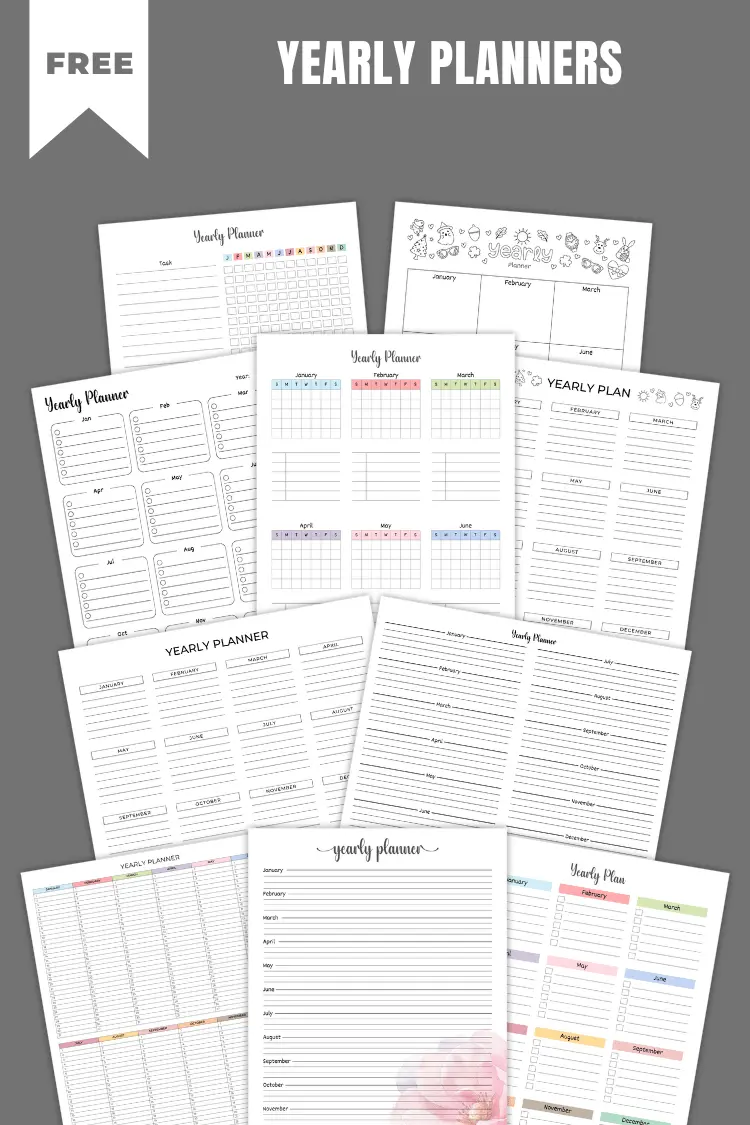

On this page, you will find a variety of debt snowball worksheet and tracker templates in different layouts, ranging from simple designs to more detailed formats to match your planning style. Whether you prefer a simple debt snowball worksheet or debt tracker with visual progress thermometers, you can download the PDF templates below, print, and use them to write down all your debts, record the minimum payments each month, and continue tracking your progress until all debts are fully paid.

Find the following section below:

- Debt Snowball Worksheets

- Debt Snowball Trackers

Take a look at these Free Printables and Templates before you go!

To begin, just scroll down the page to find all the Free Printable Debt Snowball Worksheet and Tracker Templates. Pick your favorite or choose as many as you like, click on any image to open the PDF file, download it to your computer, and print as many copies as you want. These templates are in standard US letter size but also fit well on A4 paper.

Please note that these printables are for personal use only. Redistribution, modification, or selling is not allowed.

Debt Snowball Trackers

Choose from the free debt snowball trackers below to track your progress on each debt until it is completely paid off.

Debt Snowball Worksheets

These worksheets help list each debt from smallest to largest, including debt information like balance, minimum monthly payment, and any extra you plan to pay each month. You can tick off each debt once it is paid.

What is the Debt Snowball Method?

The debt snowball method involves listing all your debts from the smallest to the largest and making minimum payments on all except the smallest one. You put all extra money toward that smallest debt first. Once it is paid off, you take the amount you were paying on it, including the extra amount, and apply it to the next smallest debt. This cycle continues until all debts are paid. Paying off the smallest balances first gives you a quick sense of progress, which helps keep you motivated as you move forward.

Debt snowball vs Avalanche

| Debt Snowball | Debt Avalanche | |

| What to pay first | Smallest debt balance first | Highest interest rate debt first |

| Order of payments | List debts smallest to largest, pay minimums on all, except pay extra on smallest | List debts by interest rate, pay minimums on all, except pay extra on highest rate |

| Motivation | Quick wins keep you motivated | Can take longer to see progress, but saves the most money |

| Goal | Feel progress quickly, build momentum | Pay less interest overall |

| Best for | People who need motivation and small wins | People focused on saving the most money |

More Templates

Looking for more printables? Visit our Printable Planner collection page to explore different categories that help you stay organized. You may also like:

Follow us on Pinterest for more free Printables :

Feel free to comment if you have any questions or need further assistance. In the meantime, if you liked this post, show your support by saving it to using the ‘Pinterest Save’ button below!